Overview of the Economy

EDUCATION & WORKFORCE DEVELOPMENT

Total Population

281,045

seCTer

Unemployment Rate

3.7%

seCTer

High School Graduate or Higher

92.17%

seCTer

Civilian Labor Force

62.08%

seCTer

EDUCATION

Education is fundamental to competitiveness, capacity for innovation, resilience, quality of life, and readiness. In an age of globalization and international trade, countries and their economies continually compete with each other. The same competition occurs at the state and regional level. Every region would like to hold competitive and comparative advantages over neighboring regions – and having a skilled productive workforce can provide one such advantage.

SECT is fortunate to have numerous public and private educational institutions that are actively engaged in preparing their students for success in a challenging economic climate. As a region, developing innovative strategies that address inefficiencies and fuel new investment in education will be crucial in providing the types of programming that align with current realities. Also crucial is investment in science, technology, engineering and mathematics (STEM) education and skills training, entrepreneurship, and the critical thinking skills needed in current high-tech environment. Focus must remain on competency, skills development and investment in education (subsidies) to improve curriculum, engage disadvantaged populations through alternative and/or affordable platforms for learning, and foster entrepreneurship to expedite personal resilience.

WORKFORCE

Housing and jobs within the region are isolated and the lack of public transportation in certain parts of the region is a challenge for both employers needing to access labor pools and workers to access potential jobs. Equally as important as career training programs are the wrap-around services needed in the region to reduce the challenges associated with job access (transportation) and personal and family needs.

The region’s leaders must create a diverse and inclusive workforce that meets current and future industry needs. For example, there continues to be a shortage of skilled labor in the region, particularly fabricators, and this is major problem for the region’s smaller companies who face the additional burden of competing with GDEB and other larger companies for these workers.

The Eastern Connecticut Workforce Investment Board (EWIB) is an award-winning, nonprofit workforce development organization that has been serving Eastern Connecticut since 1985. EWIB services a 41-town area by coordinating a dedicated network of partners to implement programs and initiatives including 1) three job center locations, 2) industry-led manufacturing and healthcare workforce pipeline programs, 3) a variety of workforce preparation programs for youth, and 4) a range of services for employers (Home (ewib.org)).

In its 2022 Local Plan Modification, EWIB “maintains a vision that Eastern Connecticut will create and sustain the global economy’s best-educated, most-skilled, highest-productive workforce, with increased access to opportunities for all residents to pursue rewarding careers, such that every business has access to a qualified, skilled, job-ready workforce” (

Noted workforce advancements in the region are listed in Table 8 below. 2022 Plan Update – Submitted Plan Only – 06-14-22.pdf (ewib.org)).

WORKFORCE HOUSING

“Local control” as it currently exists is used to preserve an unequal and exclusionary status quo and is damaging Connecticut’s long-term vitality.”

– https://ctmirror.org/2022/09/19/connecticut-local-control-housing-shortage

Connecticut’s lack of available housing for low-income people is tied to restrictive local zoning laws that make it difficult to build affordable multifamily housing. Local and state representatives must understand that affordable housing is a crucial component of economic development and that there is a social cost to the housing shortage. Analysis from the National Association of Home Builders shows that for every $1 the state invests in building affordable homes, $4.57 in private investment is leveraged. When the workforce must spend more and more of their income on housing, they spend less on goods and services in the local economy. Families are having to pay half or more of their income for rent, workers are commuting for hours because they cannot afford to live anywhere near work, and young people are leaving for lower-cost states. These people are not represented at all in the current political process.

“In addition to workforce development programs, the provision of appealing, affordable housing is crucial to the success of attracting the millennials, sought to fill the anticipated job openings (particularly at Electric Boat) over the next decade. Housing needs for the increasing senior population are very similar to those of millennials: both desiring smaller, rental units within walking distance of basic services including healthcare, employment and entertainment. SECT’s housing stock is primarily single-family detached units, while the vast majority of multi-family rental units are slightly outdated and located in the urban centers.”

– CEDS 2017

Reform is needed at the state and local level with respect to governance systems which often exclude broad public participation and advance the interests of local property owners who are able to be present for evening meetings. Research has shown that those who participate in local politics either through voting or showing up to town meetings are overwhelmingly wealthy, older property owners whose desire to maintain the status quo often conflicts with the interests of younger people, renters, workers and families who need access to homes, jobs, childcare, medical care and other services. Having clear local and regional targets for new homes, educational and medical facilities, etc., that localities must comply with through new zoning are vital to ensuring that all residents have access to the housing and services they need.

The Southeastern Connecticut Housing Needs Assessment 2018 by SCCOG concluded that the Southeastern Connecticut region lacks appropriate housing. Throughout the state nearly 140,000 households are extremely low income and severely cost burdened (A Fair Share Housing Model for Connecticut – Open Communities Alliance (ctoca.org)). The demand for low-cost rentals and single-family homes is most likely to come from young, newly-forming households and retirees looking to stay in the region (2018_Housing_Needs_Assessment_03162018.pdf (seccog.org)).

The following housing-related facts/trends were identified:

- Continued decline in average household size means need for housing will grow faster than population

- Baby boomers are downsizing

- Housing preferences of younger residents are shifting toward urban locations

- General Dynamics Electric Boat continues to grow

- Affordability challenges are increasing for renters and owners alike, with 29,000 households living in houses they can’t afford in the region

- Demand for low-income housing is increasing

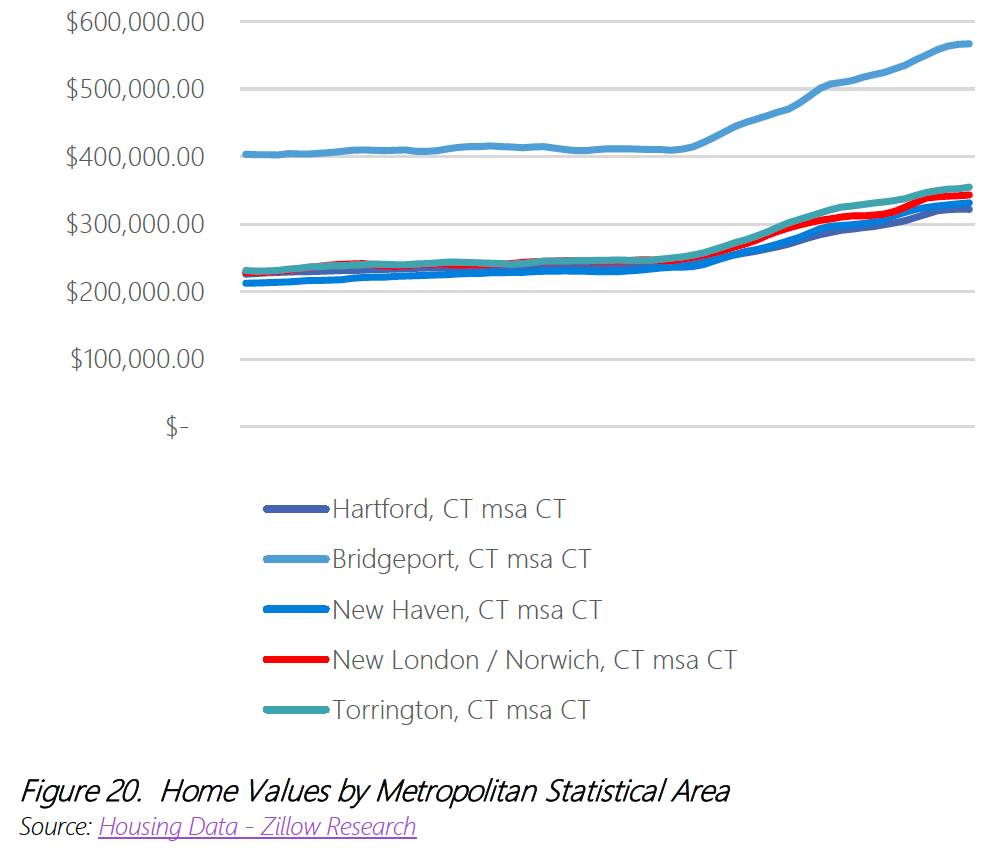

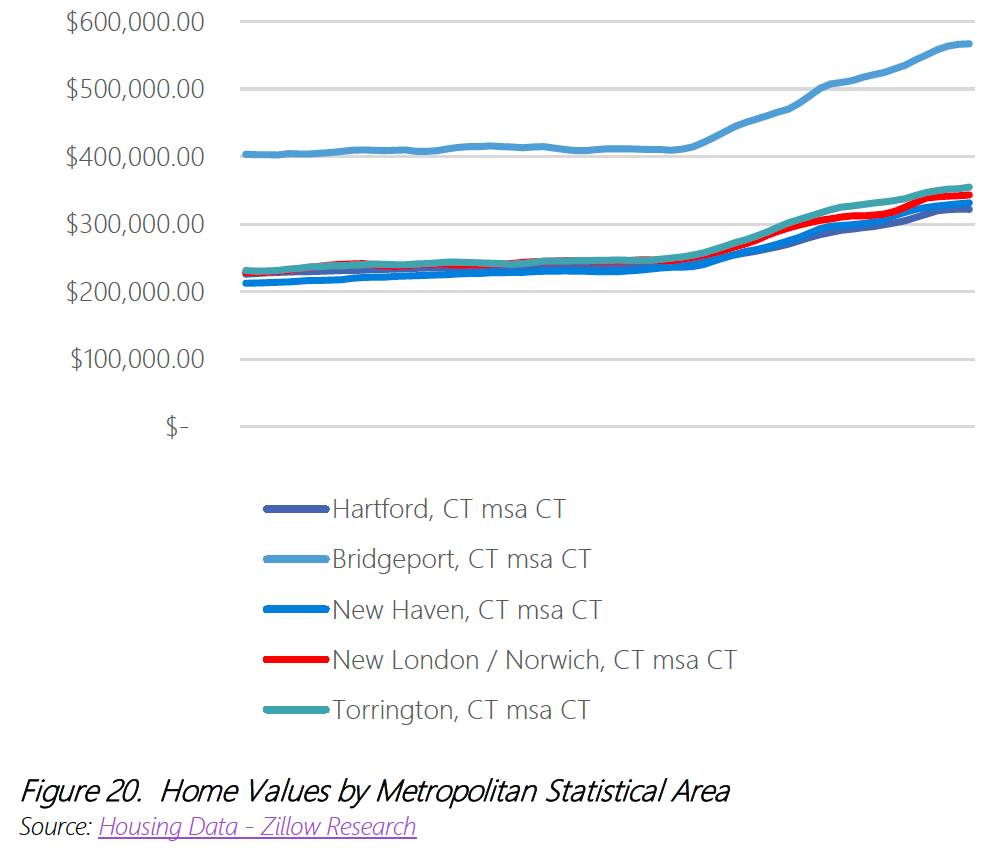

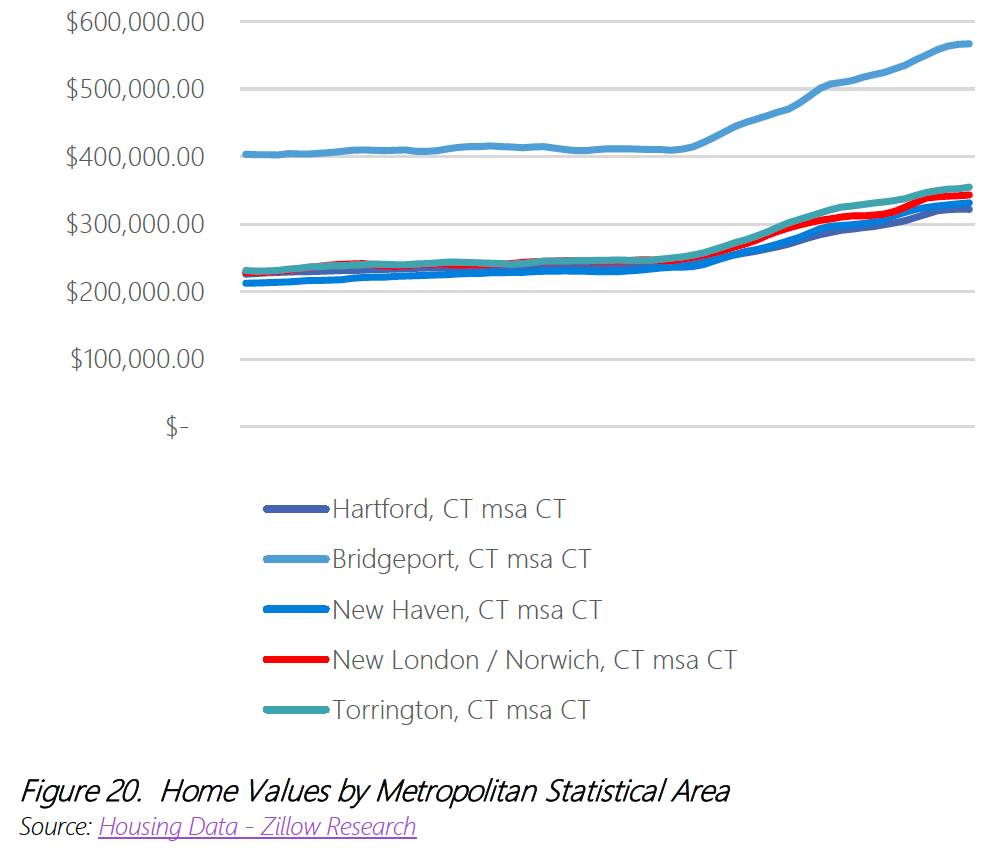

- 30 percent of owners are cost-burdened (Figure 20)

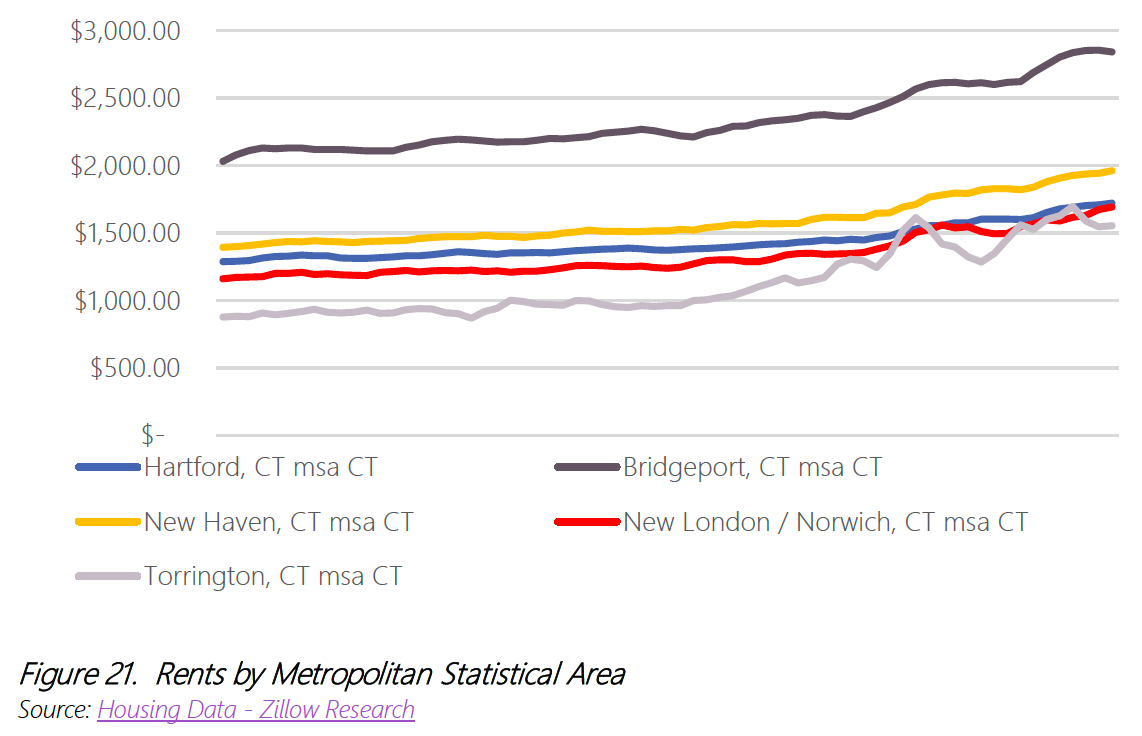

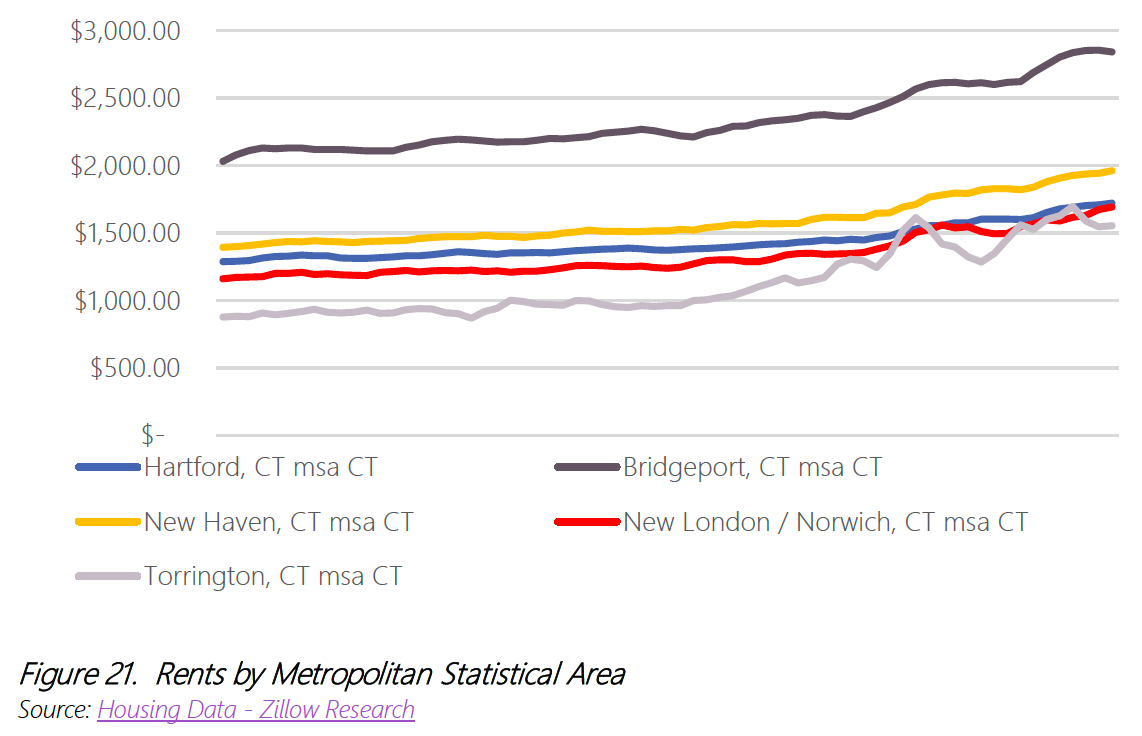

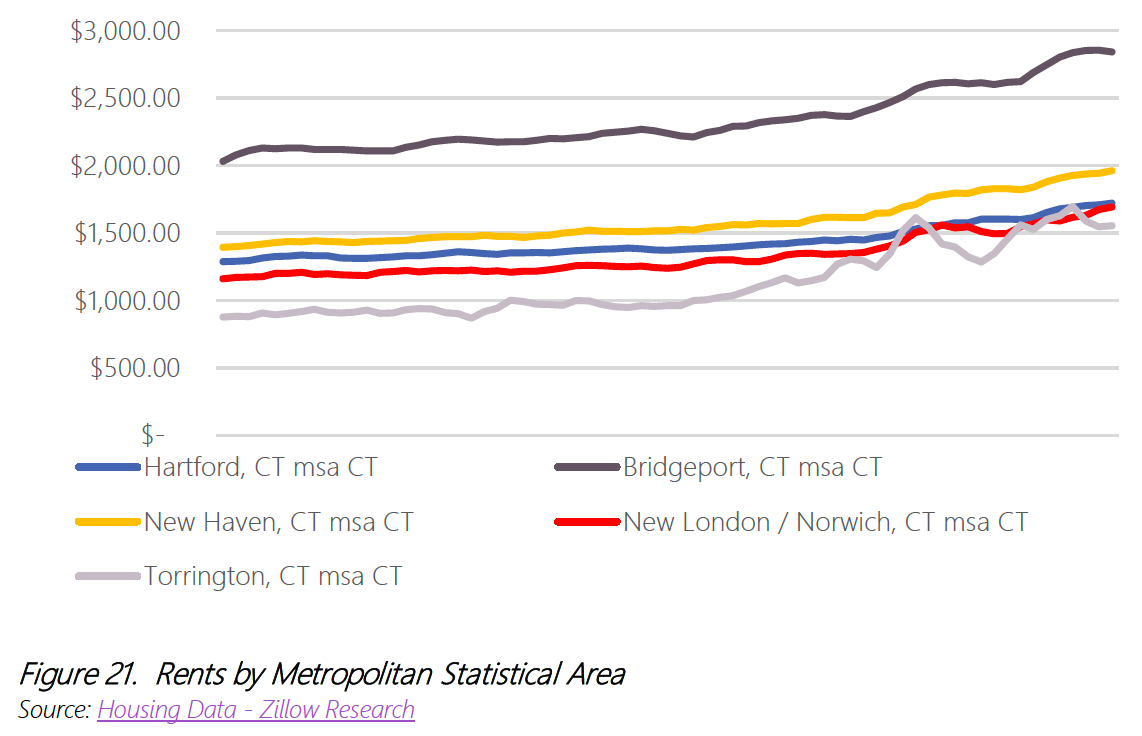

- 48 percent of renters are cost-burdened (Figure 21)

- Lack of sewer limits development

“The reality is the economic engine of our state is dependent on the workforce, and the workforce is linked with affordable housing.”

– CT Sen. Saud Anwar, Housing Committee

A February 2023 article in the Washington Post explored the increasing distorting role all-cash buyers are playing in the U.S. housing market (See how many all-cash buyers snagged houses in your neighborhood – Washington Post). Key quotes from this article are relevant to the housing market in Southeastern Connecticut:

- “Last year, nearly a third of U.S. homes were purchased with cash …. an 8 percent increase from 2021, continuing a trend that started during the pandemic. The share of homes bought with cash is now at levels not seen since 2014, when the housing market was on the rebound after the foreclosure crisis and the Great Recession.”

- “Early in the pandemic, home buyers seeking more space desperately outbid one another in the frenzied housing market. Now all-cash offers continue, even as the housing market has cooled, as a way to sidestep rising interest rates.”

- “The rise of all-cash buys comes at a time when the average home buyer is increasingly likely to be White, wealthy and older and the proportion of first-time buyers is at its lowest in more than 40 years.”

- “Only the wealthy are essentially buying homes …. “If this trend was to continue, that means something fundamentally is wrong with society.”

- “Retirees, buyers who relocated using home equity proceeds, foreign buyers, investors and high-wealth individuals all outgunned bidders who needed the help of banks to finance their offers …. ”

- “The pandemic also reoriented people’s values toward activities that required more land …. such as hosting friends, gardening and swimming in backyard pools.”

-

The ability to work from home has resulted in “increased remote-work lifestyles and people leaving large city centers.” Said another way, many white-collar workers in high-paying industries like high tech and finance transitioned to more flexible remote-work assignments.

-

“What we found was those that already were more well-off were able to take advantage of the strong housing market and add to their wealth, while those trying to better their situation were often pushed to the side …. ”

Collectively, cities and towns in the region allocated less than 1 percent of federal ARPA funding to help reduce Connecticut’s housing problems. There were notable exceptions, however. Stonington allocated roughly $170,000 – 3 percent of its federal funds – for housing-related projects, including a revolving loan fund that will help low- and moderate-income homeowners make repairs on their properties. Ledyard allocated $100,000 for a similar revolving housing rehab loan program. Norwich, which is home to roughly 40,000 people, set aside $889,000 for rental and mortgage assistance and another $1.1 million to help create and preserve affordable housing in the city. New London allocated $610,000 towards housing. The Town of Groton allocated $175,000 toward housing programming (American Rescue Plan | Greater Groton).

The following housing-related facts/trends were identified:

- Continued decline in average household size means need for housing will grow faster than population

- Baby boomers are downsizing

- Housing preferences of younger residents are shifting toward urban locations

- General Dynamics Electric Boat continues to grow

- Affordability challenges are increasing for renters and owners alike, with 29,000 households living in houses they can’t afford in the region

- Demand for low-income housing is increasing

- 30 percent of owners are cost-burdened (Figure 20)

- 48 percent of renters are cost-burdened (Figure 21)

- Lack of sewer limits development

“The reality is the economic engine of our state is dependent on the workforce, and the workforce is linked with affordable housing.”

– CT Sen. Saud Anwar, Housing Committee

A February 2023 article in the Washington Post explored the increasing distorting role all-cash buyers are playing in the U.S. housing market (See how many all-cash buyers snagged houses in your neighborhood – Washington Post). Key quotes from this article are relevant to the housing market in Southeastern Connecticut:

- “Last year, nearly a third of U.S. homes were purchased with cash …. an 8 percent increase from 2021, continuing a trend that started during the pandemic. The share of homes bought with cash is now at levels not seen since 2014, when the housing market was on the rebound after the foreclosure crisis and the Great Recession.”

- “Early in the pandemic, home buyers seeking more space desperately outbid one another in the frenzied housing market. Now all-cash offers continue, even as the housing market has cooled, as a way to sidestep rising interest rates.”

- “The rise of all-cash buys comes at a time when the average home buyer is increasingly likely to be White, wealthy and older and the proportion of first-time buyers is at its lowest in more than 40 years.”

- “Only the wealthy are essentially buying homes …. “If this trend was to continue, that means something fundamentally is wrong with society.”

- “Retirees, buyers who relocated using home equity proceeds, foreign buyers, investors and high-wealth individuals all outgunned bidders who needed the help of banks to finance their offers …. ”

- “The pandemic also reoriented people’s values toward activities that required more land …. such as hosting friends, gardening and swimming in backyard pools.”

-

The ability to work from home has resulted in “increased remote-work lifestyles and people leaving large city centers.” Said another way, many white-collar workers in high-paying industries like high tech and finance transitioned to more flexible remote-work assignments.

-

“What we found was those that already were more well-off were able to take advantage of the strong housing market and add to their wealth, while those trying to better their situation were often pushed to the side …. ”

Collectively, cities and towns in the region allocated less than 1 percent of federal ARPA funding to help reduce Connecticut’s housing problems. There were notable exceptions, however. Stonington allocated roughly $170,000 – 3 percent of its federal funds – for housing-related projects, including a revolving loan fund that will help low- and moderate-income homeowners make repairs on their properties. Ledyard allocated $100,000 for a similar revolving housing rehab loan program. Norwich, which is home to roughly 40,000 people, set aside $889,000 for rental and mortgage assistance and another $1.1 million to help create and preserve affordable housing in the city. New London allocated $610,000 towards housing. The Town of Groton allocated $175,000 toward housing programming (American Rescue Plan | Greater Groton).

The following housing-related facts/trends were identified:

- Continued decline in average household size means need for housing will grow faster than population

- Baby boomers are downsizing

- Housing preferences of younger residents are shifting toward urban locations

- General Dynamics Electric Boat continues to grow

- Affordability challenges are increasing for renters and owners alike, with 29,000 households living in houses they can’t afford in the region

- Demand for low-income housing is increasing

- 30 percent of owners are cost-burdened (Figure 20)

- 48 percent of renters are cost-burdened (Figure 21)

- Lack of sewer limits development

“The reality is the economic engine of our state is dependent on the workforce, and the workforce is linked with affordable housing.”

– CT Sen. Saud Anwar, Housing Committee

A February 2023 article in the Washington Post explored the increasing distorting role all-cash buyers are playing in the U.S. housing market (See how many all-cash buyers snagged houses in your neighborhood – Washington Post). Key quotes from this article are relevant to the housing market in Southeastern Connecticut:

- “Last year, nearly a third of U.S. homes were purchased with cash …. an 8 percent increase from 2021, continuing a trend that started during the pandemic. The share of homes bought with cash is now at levels not seen since 2014, when the housing market was on the rebound after the foreclosure crisis and the Great Recession.”

- “Early in the pandemic, home buyers seeking more space desperately outbid one another in the frenzied housing market. Now all-cash offers continue, even as the housing market has cooled, as a way to sidestep rising interest rates.”

- “The rise of all-cash buys comes at a time when the average home buyer is increasingly likely to be White, wealthy and older and the proportion of first-time buyers is at its lowest in more than 40 years.”

- “Only the wealthy are essentially buying homes …. “If this trend was to continue, that means something fundamentally is wrong with society.”

- “Retirees, buyers who relocated using home equity proceeds, foreign buyers, investors and high-wealth individuals all outgunned bidders who needed the help of banks to finance their offers …. ”

- “The pandemic also reoriented people’s values toward activities that required more land …. such as hosting friends, gardening and swimming in backyard pools.”

-

The ability to work from home has resulted in “increased remote-work lifestyles and people leaving large city centers.” Said another way, many white-collar workers in high-paying industries like high tech and finance transitioned to more flexible remote-work assignments.

-

“What we found was those that already were more well-off were able to take advantage of the strong housing market and add to their wealth, while those trying to better their situation were often pushed to the side …. ”

Collectively, cities and towns in the region allocated less than 1 percent of federal ARPA funding to help reduce Connecticut’s housing problems. There were notable exceptions, however. Stonington allocated roughly $170,000 – 3 percent of its federal funds – for housing-related projects, including a revolving loan fund that will help low- and moderate-income homeowners make repairs on their properties. Ledyard allocated $100,000 for a similar revolving housing rehab loan program. Norwich, which is home to roughly 40,000 people, set aside $889,000 for rental and mortgage assistance and another $1.1 million to help create and preserve affordable housing in the city. New London allocated $610,000 towards housing. The Town of Groton allocated $175,000 toward housing programming (American Rescue Plan | Greater Groton).