Overview of the Economy

Transportation

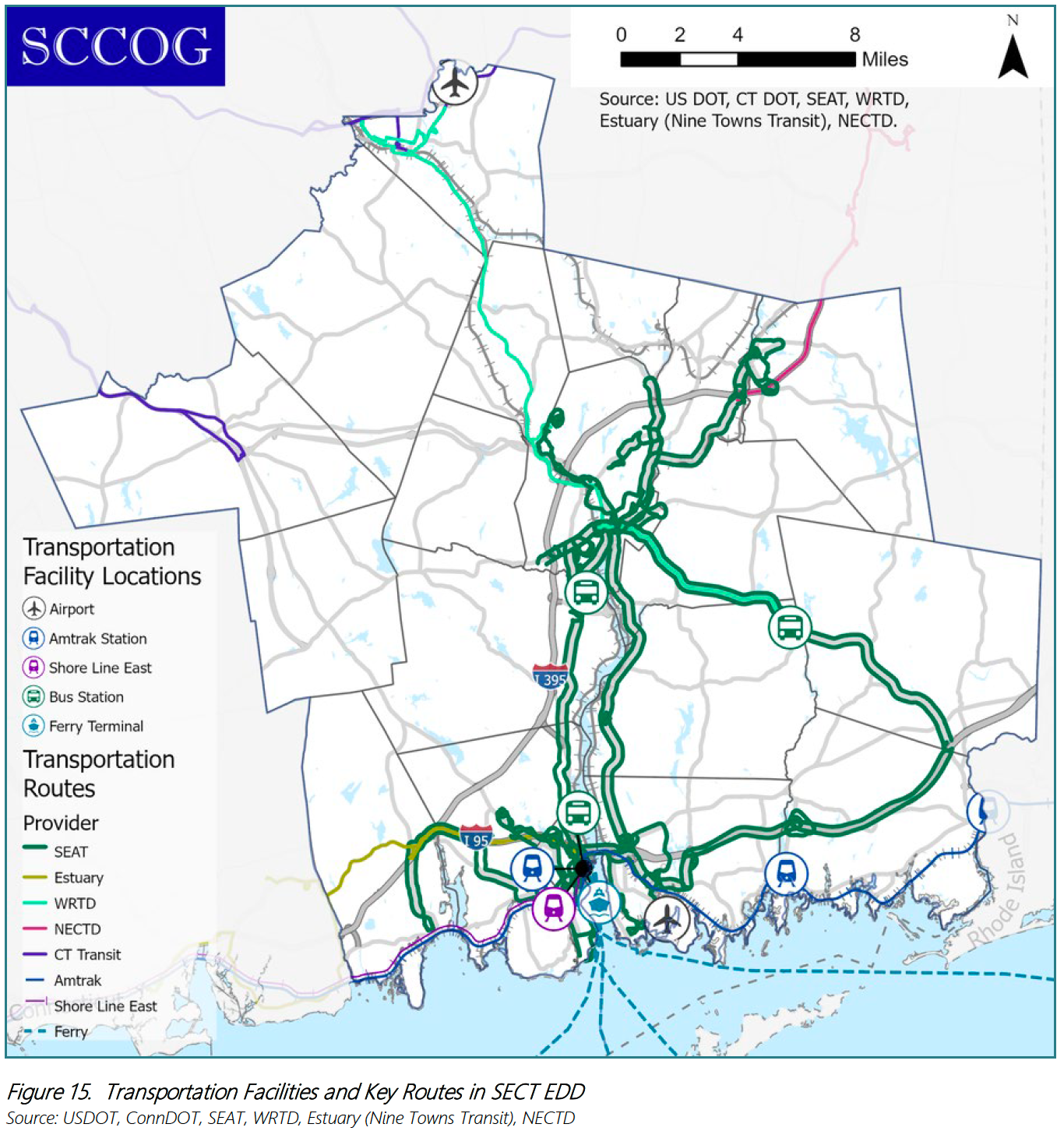

The network of transportation corridors and services throughout the region consists of two major highways, freight and passenger rail lines, bus services, two regional airports, passenger ferry service, and shipping services (Figure 15).

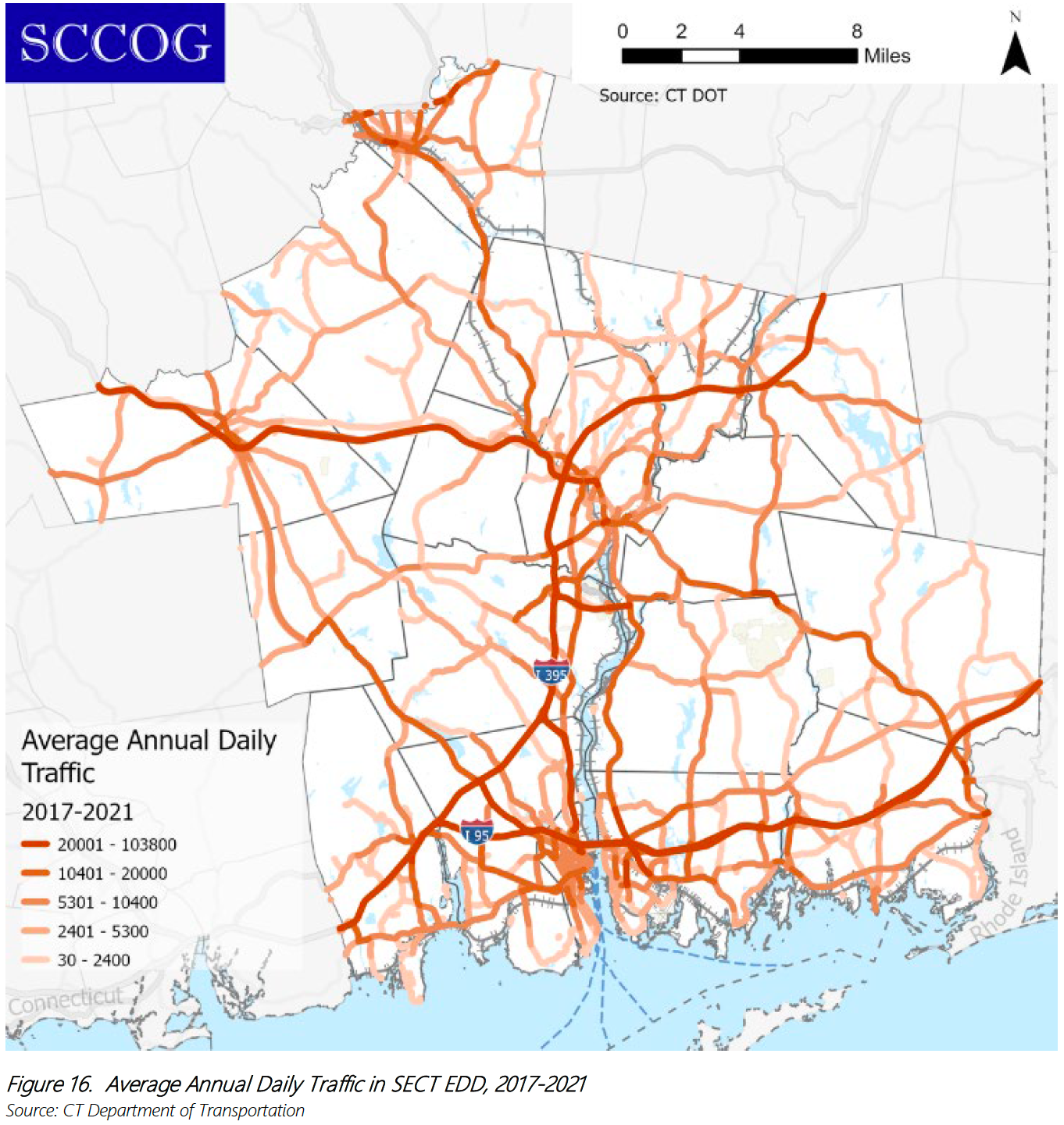

Interstate-95, serving the east-west corridor in the region, is the most heavily traveled thoroughfare along the Atlantic Coast from Florida to Maine (Figure 16).

As identified in the SCCOG Regional Plan of Conservation and Development 2017, the region’s dispersed development patterns have affected its ability to provide public transportation service at frequencies and to locations that effectively and efficiently serve its residents (RPOCD_Full-Document_11-16-2017.pdf (seccog.org)). This has particular effect on residents who cannot drive or lack access to a vehicle. This issue is likely to grow in importance with an aging population.

The pandemic affected people’s choices around mobility. Daily decisions about remote work and commuting, where to live or study, whether to go out to eat, shop or order on line, and whether to get on a plane to go on vacation or rent an RV all had a huge impact on transportation. During the depths of the pandemic, people still used public transportation – many had to – but were wary of close contact forcing transportation service providers to adapt. The impacts of the pandemic on transit ridership remain and are reverberating through the transportation system, and transportation providers continue to explore innovative ideas to address safety concerns and maintain ridership.

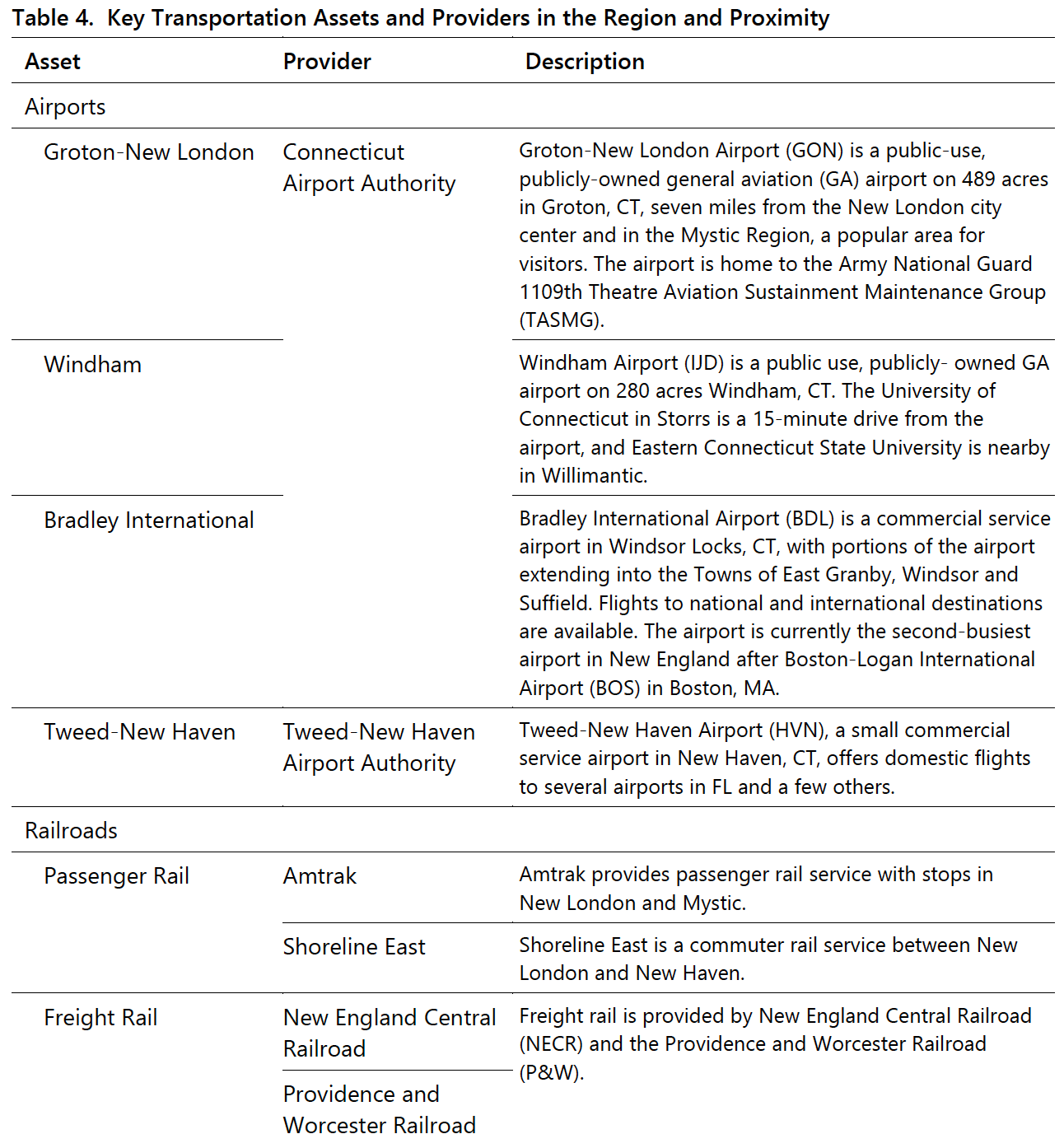

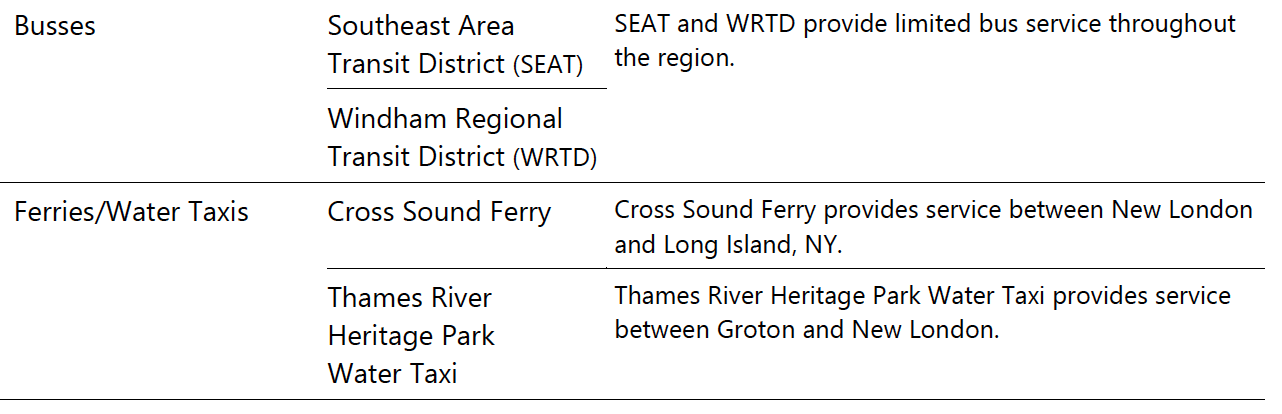

Key transportation assets and providers in the region are listed in Table 4.

One of the region’s prime transportation assets is the port of New London and its shore-based facilities, most notably the State Pier. Located at the mouth of the Thames River, the port of New London is a protected deepwater port with unobstructed access to the Atlantic Ocean and is situated along a federally-designated Maritime Highway.

One of the key emerging economic development forces in the EDD is the nascent but growing offshore wind industry, and the State of Connecticut is responding and reacting proactively. Public Act No. 19-71, An Act Concerning the Procurement of Energy Derived from Offshore Wind, was passed by the Connecticut General Assembly on June 7, 2019. The act requires the Connecticut Department of Energy and Environmental Protection (DEEP), in consultation with others, to solicit proposals from Class I offshore wind facilities with a total nameplate capacity of 2,000 megawatts (MW) in the aggregate. Among other things, the act requires (1) bidders to include an environmental and fisheries mitigation plan for building and operating their offshore wind facilities, and (2) DEEP to establish a commission on environmental standards to inform these plans (An Act Concerning the Procurement of Energy Derived from Offshore Wind).

DEEP established the commission on environmental standards in June 2019, and the commission released its final report in August 2019. In June 2009 DEEP issued a request for proposals (RFP), subsequently receiving 46 bids from three developers:

Constitution Wind (Bay State Wind), Mayflower Wind, and Vineyard Wind. In December 2019, DEEP selected Vineyard Wind’s 804 MW Park City Wind Project for development.

In August 2020, Public Utilities Regulatory Authority (PURA) approved power purchase agreements (PPAs) between Vineyard Wind and the state’s electric utilities for the Park City Wind Project and authorized the companies to recover costs and credit revenues through the non-by-passable federally mandated congestion charge (a component of ratepayer bills) (Offshore Wind Procurement (ct.gov)).

One key initiative currently underway in support of the offshore wind industry is the transformation of State Pier into a state-of-the-art, heavy-lift-capable port facility that will accommodate a wide variety of cargoes, including wind turbine generator staging and assembly. This expansion of the State Pier to accommodate all aspects of wind turbine assembly and delivery in particular will create an exciting opportunity for the region to become a significant hub for the offshore wind energy industry.

The State Pier project has received $255 million in investment through a public-private partnership between the State of Connecticut and Revolution Wind (a 50/50 partnership between Eversource Energy, a major New England utility company, and Ørsted, a Danish wind farm developer): $180 million through the quasi-public Connecticut Port Authority and $75 million through Revolution Wind. Revolution Wind plans to begin utilizing State Pier in 2023, creating more than 400 new technically skilled jobs in the EDD.

The State Pier was also the catalyst for seCTer’s successful Phase I application in October 2021 to the U.S. Economic Development Administration’s (EDA) Build Back Better Regional Challenge (BBBRC). seCTer received $500,000 from EDA to further advance its development projects. In March 2022 a set of six projects forming an Offshore Wind Industry Cluster (OWIC) was submitted to EDA in BBBRC’s Phase II competition. The six projects, representing $63 million in regional investment from EDA, the State of Connecticut and private partners, were aimed at diversifying and expanding the supply chain, providing waterfront industrial sites for development, building a green business park, leveraging a replicable workforce development model, supporting blue tech research and development, and bringing innovative new products to production. According to a regional economic modeling study commissioned by seCTer for the Phase II application, direct and indirect impacts due to the six projects would initially produce 9,000 jobs and sustain another 6,500 jobs for decades.

Unfortunately, the seCTer-sponsored OWIC was not named a Phase II awardee, but seCTer continues to actively market and promote the region to potential offshore wind developers (About – seCTer (southeasternctwind.com)).